End of Summit

Hosted by Asian Metal and supported by Shaanxi Tianyu Magnesium Industry Group, the 8th Magnesium Summit was held in Zhuhai city, Guangdong province on April 11-12, 2019. The meeting had topics on various magnesium products including ingot, powder, alloy, alloy die casting, alloy extruded product, and Mg-Al alloy. Over 200 participants from both Chinese and overseas magnesium industries were present at the meeting.

At 9:00 on April 12, the meeting was opened with a speech by Mr. Genyong Chen, Chairman of Fugu County Magnesium Association and President of Shaanxi Tianyu Magnesium Industry Group. According to Mr. Chen, the magnesium industry underwent a number of major events in 2018, including price soaring in ferrosilicon, limitation policies on dolomite mining, limitation policies on transporting vehicles' loads and environmental inspections. Affected by raw material costs and environmental inspections, China's magnesium ingot output has showed a notably dropping trend since early this year, leading to tight supply and rising prices for magnesium ingot. Mr. Chen committed his company to complying with government policies in the magnesium industry and on environmental inspections; further, his company would try to maintain normal production, stick to high product quality, and operate in a way a market economy requires, letting the market decide what prices are reasonable and how big a share the company can win. According to Mr. Chen, a significant challenge that magnesium professionals will meet in the future is the magnesium industry's technical upgrading in terms of mechanization, automation and intelligentization.

Mr. Zhibo Duan, Deputy County Chief of People's Government of Fugu County, who made a speech titled Add Color to Chinese Magnesium Industry & Lay Foundation for Global Magnesium Market. He pointed out that in Fugu county the magnesium industry is the second largest industry just following the coal industry, and also is the core part of Fugu's circular industry conglomerate; Fugu magnesium industry has the following advantages, large production size, high product quality, advanced production technology and low production costs; in 2018 Fugu's magnesium ingot output was 370,000t, accounting for 50% of the national total and about 40% of the global total, therefore enabling Fugu to play a great stabilizing role in the Chinese and global magnesium supply chain.

Mr. Xunyou Tong, President of Magontec Xian Co. Ltd. In his speech titled Magnesium Industry in the Modern Era, he pointed out the magnesium ingot and magnesium alloy industries faced pressure in production and supply stages, such as new environmental policies and labor shortage as well as higher requirements on raw material qualities. In response, Qinghai Salt Lake Industry and Magontec Qinghai put forward solutions to make their magnesium ingot and alloy production more environmentally friendly, more technically advanced; as a result, their supply and product qualities were more stable. The application markets of magnesium alloy were shifting from the European-American region to the Chinese market, where magnesium alloy will find more and broadened applications in the future. Magnesium alloy has wide application prospective in industries including new energy car, rail transportation, construction template, 3C electronic product in the 5G era.

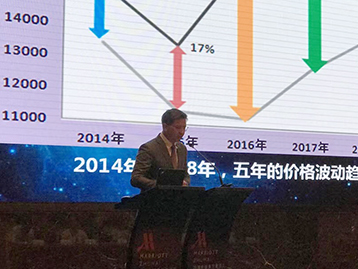

Mr. Ray Yang, Vice General Manager of Shaanxi Tianyu Magnesium Group delivered the following speech Analysis of Price Fluctuation for Magnesium Ingot on the Perspective of Demand and Supply. His speech included analysis on a number of factors related to magnesium price fluctuations such as raw material supply (coal, dolomite and ferrosilicon), government policies, and exports and domestic consumption. He thought that magnesium ingot producers should comply with changes in supply-demand status, and should have their prices adjusted by the market; magnesium producers should try to cut their production costs, increase product qualities and optimize production process so as to offset impacts caused by changing production costs; and downstream consumers should work together with magnesium producers in expanding magnesium products' applications, consummating production technologies and promoting research so as to ensure that the magnesium market moves ahead in a healthy and stable way.

Mr. Jinyao Mu, General Manager of Tianjin Dongyi Magnesium Products Co., Ltd., made the following speech titled Compound Innovation Facilitates Application of Magnesium alloy Extruded Profiles. According to Mr. Mu, Dongyi Magnesium Products is a full industry chain company integrating businesses from magnesite mining, magnesium ingot production and magnesium alloy production to production of magnesium alloy extruded products and die-casting products, and finally to designing of magnesium alloy end products; the company is China's largest producer of magnesium alloy cathode material and 3C material, and the largest producer of magnesium alloy extruded products, and one of the world's leading producers of magnesium alloy products.

Mr. Jianyong Cao, Chairman of Chongqing Hangyan Magnesium New Materials Application Institute Co., Ltd. made the next speech titled Review on Applications of Forged and Wrought Magnesium-alloy Products. In his speech, Mr. Cao pointed out that, with production technologies on magnesium alloy extruded products maturing, magnesium alloy products are enjoying massive application now, and especially in an era when new energy cars are booming, demand for magnesium-alloy parts is growing. In contrast, Magnesium alloy section products and forged products have better performances and are more suitable for large-sized industrial production. Mr. Cao believed that in the coming years magnesium alloy forged and extruded products will surely have wider applications in different fields.

At 14:00 of 12 April, Mr. Bart Udeshi, Vice General Manager of Metals Range's made a speech titled The Future of Magnesium in India. According to Mr. Bart Udeshi, the Indian market shows great potential for magnesium consumption. Indian government has planned to increase its car exports by four times during the period from 2016 to 2026; during the 2013-2018 period, the Indian domestic market saw an annual compound growth rate of 7.01%; in the 2019 fiscal year, the Indian semitrailer industry is expected to grow by 8-10%; in January 2019 India's car sales reached 1,565,150 cars, up by 8.5% MOM. At the same time, the Indian market enjoys better development opportunities as its government has announced a series of development targets, including expanding its electric vehicle industry and accordingly solving the issue of cutting vehicle emissions, promoting technical innovations on engine and replaceable fuels; trying to build India into a research center, building India into a leading country by 2030 in the field of mobile information-shared public system, therefore providing market opportunities for electric vehicles and autonomous cars.

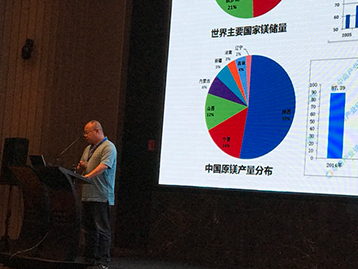

Mr. Zhenjiang Li, General Manager of Hebi Jianglang Metals Co., Ltd. made the following speech Review and Outlook on Magnesium Powder Market. He pointed out that in 2018 the Chinese magnesium industry ran stably on the whole. In 2018 magnesium consumption by the Chinese domestic market grew to some extent, magnesium prices kept rising; but smelters faced greater environmental pressure, deep-processed magnesium products still needed to find larger application markets, and there was still a long way ahead for the magnesium market in its efforts of realizing industrial upgrading. In 2018, China's magnesium ingot output registered 860,000t, down by 5.4% YOY; declining supply helped drive magnesium prices up, and the annual average magnesium price was RMB16,448/t (USD2,445/t), up by 10.5% YOY. On outlook for 2019, China and other countries' focus on development of light-weight transportation systems will provide more opportunities for the magnesium industry, but also impose higher requirements on green production of the magnesium industry, and magnesium producers should attach enough importance to improving their smelting technologies and expanding application fields. As for magnesium powder, international magnesium powder market is expected to remain stable in the future, but the Chinese domestic market will see increasing demand as Chinese steel mills try to augment their magnesium powder consumption in steel desulfurization. At present, Chinese steel mills' magnesium powder consumption is approximately 10%, much lower than the 19% rate of their foreign counterparts.

Mr. Daniel Chu, Sales Director of Yulin Tianlong Magnesium Co., Ltd. made the following speech Insight into Magnesium Ingot Industry of 2018. He pointed out that in 2018 China's magnesium ingot exports registered 208,600t, in contrast to the annual output of 863,000t which dropped by 5.44% YOY; the 2018 exports accounted for 24.17% of the national annual output, down by 2.42% from the 2017 export proportion of 26.59%. In 2018, China's magnesium ingot consumption reached 446,600t, up by 6.97% YOY; of the total consumption, consumption by metallurgical industry registered 294,500t, up by 11.3% YOY, with metallic reduction section showing the largest increase in magnesium ingot consumer, accounting for 22.92% of the total, while consumption by processing industry registered 140,100t, down by 1.27% YOY, as consumption by the 3C market dropped. Considering the current cost structure, insiders believe that in 2019 it would be reasonable for magnesium ingot prices to fluctuate within the range of RMB16,000-18,000/t (USD2,378-2,675/t), and too high or too low prices would prevent the industry from moving ahead in a healthy way. In particular, the raw coal and ferrosilicon markets will play important roles in stabilizing magnesium ingot prices.

At last, Mr. Guangning Zhang , President & General Manager of Shanxi Credit Magnesium Co., Ltd. presided over open discussion by representatives of renowned magnesium companies. Participating guests were General Manager of Hongkong Yuxin Developing Co., Ltd. Mr. Desheng Wang, Sales Director of Magontec Group Mr. Armin Buschhausen, Sales Director of Yulin Tianlong Magnesium Co., Ltd. Mr. Daniel Chu, and Chairman of Chongqing Hangyan Magnesium New Materials Application Institute Co., Ltd. Mr. Jianyong Cao.

The participating guests reached the following consensus. Firstly, the Chinese magnesium industry has established its own industrial alliances which have played a guiding role to some extent on the industry; and the large-sized magnesium producer alliance plays an increasing leading role in pricing, as every round of price decreasing can be quickly cushioned while every round of price increasing is driven by some factors. Secondly, the magnesium industry saw a balancing status between supply and demand, and large-sized companies are imposing increasing impacts upon the magnesium industry. In 2018, China's magnesium ingot output dropped by nearly 100,000t, and supply and demand reached a generally balance status; there were still surplus production capacities but the surplus capacities were cut dramatically for issues related to resources, environmental performance or capital.

Thirdly, under a background of basically balanced supply-demand status, any accidental events, such as safety events, seasonal changes, environmental inspections or seasonal equipment maintenance, would impose butterfly effects on the magnesium market, and therefore they should not been neglected. Fourthly, technical upgrading on environmental equipment has become a growth engine for magnesium companies, and investment in safety and environmental facilities will be paid back with much bigger profits; nevertheless, companies which have done so and have produced saleable products will undergo risks and responsibilities that are hard for ordinary people to imagine. Fifthly, labor shortage and increasing production costs resulting from higher production mechanization are additional important factors for the magnesium industry.

Sixthly, application of magnesium alloy is shrinking. Magnesium alloy consumption by steel and aluminum alloy industries are basically stable or drop slightly, while the slight increase in titanium sponge industry's consumption can offset the overall dropping magnesium alloy consumption. In terms of the 3C market, over 50% of its magnesium alloy consumption has been replaced by aluminum alloy as aluminum alloy prices fluctuate in a relatively stable way, not as violently as magnesium alloy prices. In 2019, if magnesium alloy producers who expect to make profits from the 3C market, they are likely to receive no orders. As for the car industry, affected by dropping car sales, magnesium die-casting companies find that orders they have received declined by about 30%, making them unable to run at full production capacity. So this is another risk for the magnesium industry.

At last, magnesium alloy industry can find a potentially great application market in the new energy vehicle industry, but in reality the penetrating process into the new energy vehicle market is slow as magnesium alloy products have high production costs, which finally restrict its usage and consumption. The existing international standard on per-car magnesium consumption is 2.5kg, while in China only some export modes of cars produced by Jili and Great Wall use magnesium alloy, and only in one or two car parts. In the light of current car prices, cars priced below RMB200,000 (USD29,726) are unable to afford over 5kg of magnesium alloy consumption. In sum, new energy vehicle industry will be another growth engine for magnesium alloy industry, but the bottleneck still exists, and only trying to expand applications will give changes to the magnesium industry.

The 8th Magnesium Summit was concluded at 18:00pm of April 12.

Having successfully hosted a large number of similar summits on various minor metals, Asian Metal would be glad to say thanks to all participating companies which have extended to us great support and coordination. With never receding enthusiasm, Asian Metal would always cling to the principle of being professional in our future work to build an exchange and sharing platform between Chinese metal market participants and their international counterparts.

Genyong Chen, President of Shaanxi Tianyu Magnesium Group & Chairman of Fugu County Magnesium Association

Zhibo Duan, Deputy County Chief of People's Government of Fugu County

Xunyou Tong, President of Magontec Xian Co. Ltd.

Ray Yang, Vice General Manager of Shaanxi Tianyu Magnesium Group

Jinyao Mu, General Manager of Tianjin Dongyi Magnesium Products Co., Ltd.

Jianyong Cao, Chairman of Chongqing Hangyan Magnesium New Materials Application Institute Co., Ltd.

Bart Udeshi, Vice General Manager of Metals Range

Zhenjiang Li, General Manager of Hebi Jianglang Metals Co., Ltd.

Daniel Chu, Sales Director of Yulin Tianlong Magnesium Co., Ltd.

Discussion

Guangning Zhang, President & General Manager of Shanxi Credit Magnesium Co., Ltd.

Armin Buschhausen, Sales Director of Magontec Group

Jianyong Cao, Chairman of Chongqing Hangyan Magnesium New Materials

Desheng Wang, General Manager of Hongkong Yuxin Developing Co., Ltd.

Daniel Chu, Sales Director of Yulin Tianlong Magnesium Co., Ltd.

Armin Buschhausen, Sales Director of Magontec Group

Jianyong Cao, Chairman of Chongqing Hangyan Magnesium New Materials

Desheng Wang, General Manager of Hongkong Yuxin Developing Co., Ltd.

Daniel Chu, Sales Director of Yulin Tianlong Magnesium Co., Ltd.

Conference

Conference

Conference

Tea Break

Tea Break

Daphne & Attendees

Daphne & Attendees

Daphne & Attendees

Daphne & Attendees

Daphne & Attendees

Daphne & Attendees